Attention Motor Vehicle Dealers

Use Quick Tax Quote Online Portal

Save Time | Eliminate Errors on Out-of-Sales Taxes

770-686-7656

Sign Up Now.......

Get Started Today!

Call us

(770) 686-7656

How Quick Tax Quote Online Portal Works

There are over 3,000 counties across all 50 states, each with its own unique mix of:

- Sales taxes

- Ad valorem taxes

- Use and wheel taxes

- Title, registration, and plate fees

- Clerk and mail fees

- Luxury taxes and special regional fees

These taxes and fees directly impact the cost of titling and registering vehicles—and you’re responsible for calculating and collecting them accurately when completing a sale. But how can you keep up without relying on expensive software or spending hours on the phone with the DMV?

One Portal. All 50 States. Accurate Quotes in Seconds.

Quick Tax Quote Online Portal simplifies the entire process. Our system allows you to calculate:

- Ad valorem taxes

- Tag, title, and registration fees

- Applicable local and state sales taxes

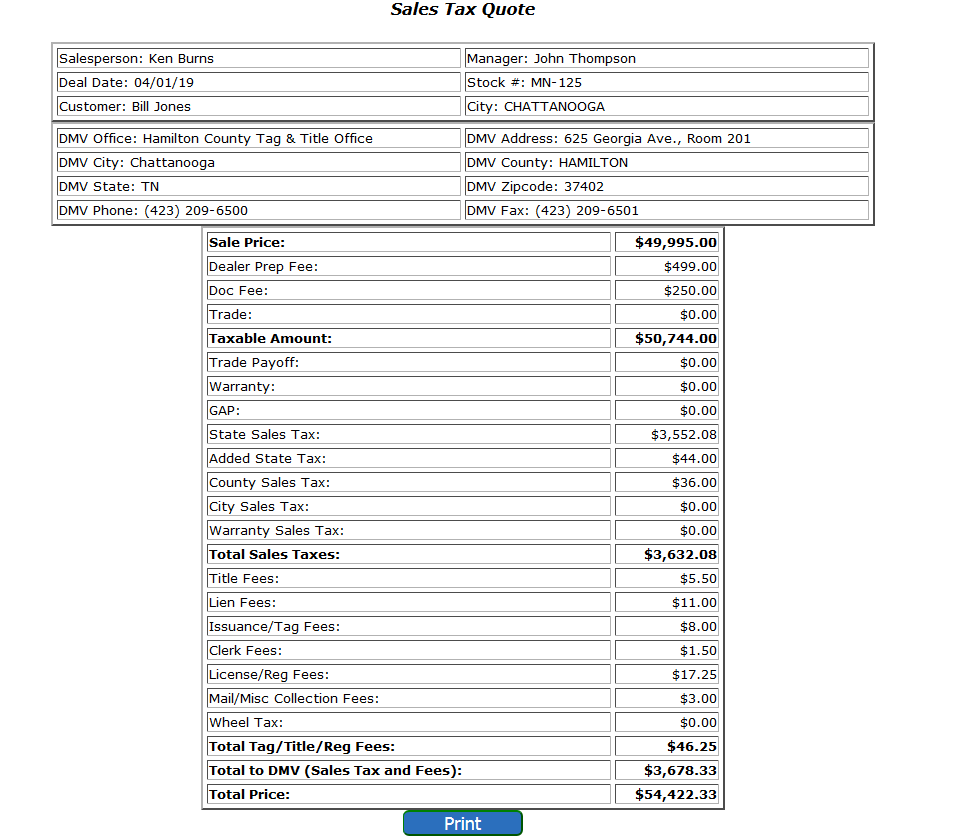

Just enter your customer’s ZIP code, the sale price, and relevant deal information. Our portal will automatically return an accurate, up-to-date breakdown of all applicable taxes and fees—whether your deal is in-state or out-of-state.

Key Features:

- Calculate payments with taxes and fees included

- Get DMV office contact details for the customer’s county

- Use the portal from your desktop, tablet, or mobile device

Always Current. Always Compliant.

Our database is regularly updated with the latest sales tax rates and registration fees across all states. Whether you’re selling locally or across state lines, Quick Tax Quote helps you stay compliant with complex tax laws—and gives your customers fast, accurate quotes every time.

Ready to save time and close deals faster?

Try Quick Tax Quote today and take the guesswork out of tax and title calculations.

Motor Vehicle – Sales and Use Tax for TN

Major Features

INSTANT OUT-OF-STATE FEE/TAX QUOTES

INSTANT OUT-OF-STATE FEE/TAX QUOTES

COMPLY WITH TAX COLLECTION LAWS

COMPLY WITH TAX COLLECTION LAWS

LOW MONTHLY COST – NO “PER DEAL” FEES

LOW MONTHLY COST – NO “PER DEAL” FEES

Disclaimer: While Quick Tax Quote strives to maintain the most accurate and up-to-date database of sales tax rates and registration fees, we cannot guarantee absolute accuracy at all times. Rates and rules may change without notice. Users are responsible for reviewing all tax data and ensuring compliance with current local and state laws. Quick Tax Quote is not liable for any financial loss, penalties, or damages resulting from the use of this tool, including miscalculations due to data errors, input mistakes, or unannounced tax changes.

Quick Tax Quote

Quick Tax Quote has complied all vehicle related registration fees and taxes (regardless of what the state/county calls them) you need to provide accurate quotes and paperwork for your customers based on their zip code and county. We even provide the appropriate required state documents (title app, odometer statement, etc.) all in one place.

Quick Tax Quote has complied all vehicle related registration fees and taxes (regardless of what the state/county calls them) you need to provide accurate quotes and paperwork for your customers based on their zip code and county. We even provide the appropriate required state documents (title app, odometer statement, etc.) all in one place.

Most importantly, you control the deal process from start to finish and no longer have to wait on an outside vendor to return a tax quote before you can provide your customer a quote and close the deal.

Most importantly, you control the deal process from start to finish and no longer have to wait on an outside vendor to return a tax quote before you can provide your customer a quote and close the deal.

Quick Tax Quote Portal expedites your deal process and gets your money faster!

Quick Tax Quote Portal expedites your deal process and gets your money faster!

Quick Tax Demo – How it Works

Benefits Of Quick Tax Quote Online Portal

QUICK & ACCURATE

1) Get instant, accurate quotes for all vehicle related fees/taxes (for any county in any state) immediately online. If the deal numbers change, you can instantly recalculate and prevent overcharges or undercharges.

LOW COST

ALL FEES

2) Get correct Tag, Title, registration and other required fees instantly for any state, including the address and contact information for the county DMV office.

EASY ACCESS

5) Access the system from any computer, tablet or mobile device that is connected to the internet. Get a tax quote for your customer even if you are out on the lot showing a vehicle.

UNLIMITED SEATS

3) Multiple users can access the system and get quotes even if someone else is also getting a quote. Increase efficiency and productivity by being able to get multiple quotes at once.

FULL CONTROL

6) Control your deal paperwork from start to finish. Eliminate the high costs of expressing contracts and paper work back and forth to outside processing centers. Finalize the deal quicker and get funded quicker.

Subscribing To Quick Tax Quote

With the Quick Tax Quote service, you only pay a monthly subscription fee to access the online portal. Here’s how it works:

We create an account for your dealership on the Quick Tax Quote Portal and all your sales/finance/office personnel will have access to the system to do their job and quickly serve your customers.

We create an account for your dealership on the Quick Tax Quote Portal and all your sales/finance/office personnel will have access to the system to do their job and quickly serve your customers.

Since there are no “per quote/per deal” fees, you may use the system to create as many quotes as you want. You may allow multiple users to use the system to create quotes at the same time.

Since there are no “per quote/per deal” fees, you may use the system to create as many quotes as you want. You may allow multiple users to use the system to create quotes at the same time.

Their are several standard subscription packages available depending on the number of states you need and we can even create a custom package for you, if needed.

Their are several standard subscription packages available depending on the number of states you need and we can even create a custom package for you, if needed.

Additional modules can be added to the basic Quick Tax Quote Portal to increase functionality. Examples are: Inventory Control, Prospect CRM and Management Reporting.

Additional modules can be added to the basic Quick Tax Quote Portal to increase functionality. Examples are: Inventory Control, Prospect CRM and Management Reporting.