Sign Up Today

Davis MO RV Camper Out-of-State Taxes

Serving These Areas Stark, Bridgeport, New Haven, Lake, New London, Worcester, Beaufort, Bay, Santa Fe, Huntington

Sign Up Now.......

Call us

(770) 686-7656

Quick Tax Quote offers the most efficient platform to calculate RV Camper Out-of-State Taxes. We service all dealers throughout the MO area.

Major Features

INSTANT OUT-OF-STATE SALES TAX QUOTES

INSTANT OUT-OF-STATE SALES TAX QUOTES

LOW MONTHLY COST – NO “PER DEAL” FEES

LOW MONTHLY COST – NO “PER DEAL” FEES

FREE ACCOUNT SETUP – EASY ONLINE ACCESS – 24 HOURS

FREE ACCOUNT SETUP – EASY ONLINE ACCESS – 24 HOURS

How Quick Tax Quote Online Portal Works!

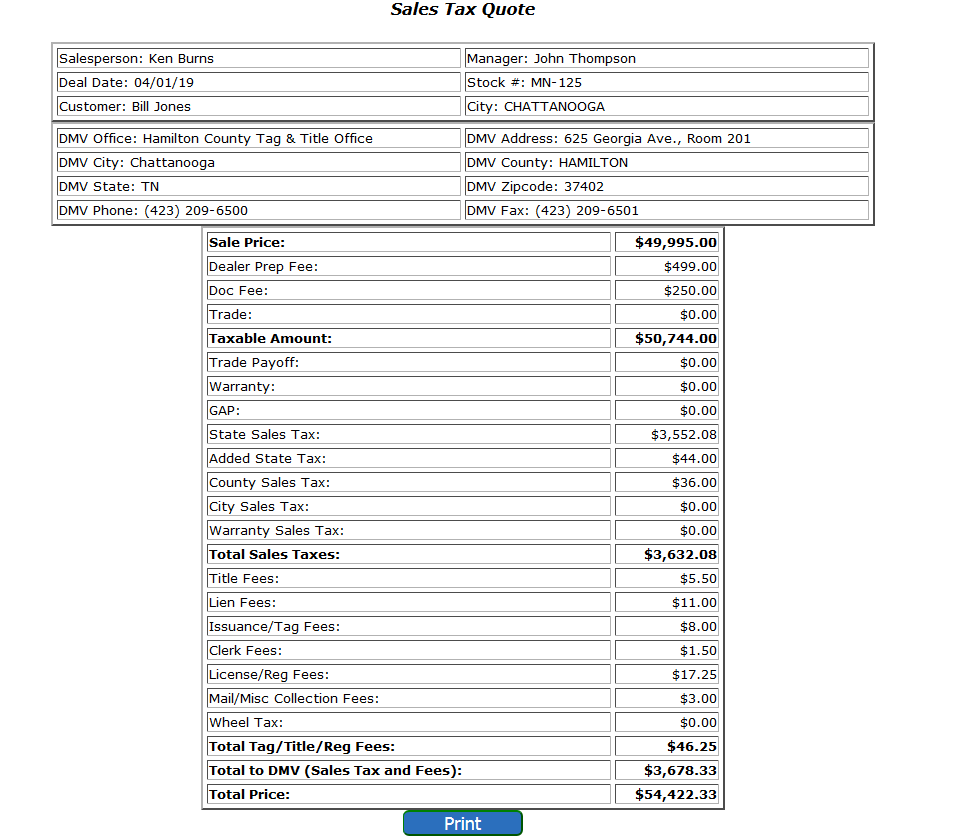

With Quick Tax Quote Online Portal, you can calculate MO or other out-of-state sales taxes, tag, title and other registration fees based on the customer’s county. You can use these rates to immediately and accurately calculate the correct sales taxes and fees for MO or any other out-of-state (or in-state) deals. Simply input your sale price and other deal numbers into the portal and the Quick Tax Quote Portal will calculate sales tax and other fees needed to give you the bottom line total. It will also allow you to calculate a payment if desired. The system will even give you the name and address of the correct DMV office for your customer’s location where the documents need to be sent for processing. You can calculate taxes and quote figures for all your customers anytime online and even from a mobile phone or tablet.

Quick Tax Quote maintains an up-to-date database of MO and all other states sales tax rates and registration fees associated with the sale of a motor vehicle and other items that are taxable in out-of-state situations.  We make it simple and easy for your business to comply with all of today’s interstate sales tax laws and regulations.

We make it simple and easy for your business to comply with all of today’s interstate sales tax laws and regulations.

Motor Vehicle – Sales and Use Tax for MO

Quick Tax Demo – How it Works

Quick Tax Quote

Quick Tax Quote guarantees sales tax calculation accuracy and also allows you to make recalculations when deal structure is altered. No more waiting on an outside service provider to send you an updated quote when you suddenly add a warranty to the deal. You also have the luxury of storing the quote into our database for future reference when needed.

Quick Tax Quote guarantees sales tax calculation accuracy and also allows you to make recalculations when deal structure is altered. No more waiting on an outside service provider to send you an updated quote when you suddenly add a warranty to the deal. You also have the luxury of storing the quote into our database for future reference when needed.

Most importantly, you control the deal process from start to finish and no longer have to out source the tax, title and registration process and wait on someone else before you can close the deal and get your funding.

Most importantly, you control the deal process from start to finish and no longer have to out source the tax, title and registration process and wait on someone else before you can close the deal and get your funding.

Quick Tax Quote Portal expedites your deal process and gets you your money faster!

Quick Tax Quote Portal expedites your deal process and gets you your money faster!

QUICK & ACCURATE

UNLIMITED SEATS

ALL FEES

EASY ACCESS

LOW Cost

FULL CONTROL

Quick Tax Quote

Quick Tax Quote guarantees sales tax calculation accuracy and also allows you to make recalculations when deal structure is altered. No more waiting on an outside service provider to send you an updated quote when you suddenly add a warranty to the deal. You also have the luxury of storing the quote into our database for future reference when needed.

Quick Tax Quote guarantees sales tax calculation accuracy and also allows you to make recalculations when deal structure is altered. No more waiting on an outside service provider to send you an updated quote when you suddenly add a warranty to the deal. You also have the luxury of storing the quote into our database for future reference when needed.

Most importantly, you control the deal process from start to finish and no longer have to out source the tax, title and registration process and wait on someone else before you can close the deal and get your funding.

Most importantly, you control the deal process from start to finish and no longer have to out source the tax, title and registration process and wait on someone else before you can close the deal and get your funding.

Quick Tax Quote Portal expedites your deal process and gets you your money faster!

Quick Tax Quote Portal expedites your deal process and gets you your money faster!

Quick Tax Quote

Coverage Area for Davis, MO

Stark, Bridgeport, New Haven, Lake, New London, Worcester, Beaufort, Bay, Santa Fe, Huntington

Monthly Portal Access

$149 Month*

w/50 State Package

Renewed Monthly

No Contract

$100 Setup Charge

$5 Discount Each Extra Location

![]() 50 State Package

50 State Package

![]() Documentation

Documentation

![]() Customer Support

Customer Support

![]() Free Updates

Free Updates

![]() Unlimited Quotes

Unlimited Quotes

* Payable Monthly in Advance. Payments can be made only by PayPal or Credit Card,

Best Value

Annual Portal Access

$1,490 Year*

w/50 State Package

Renewed Yearly

No Setup Charge

$50 Discount Each Extra Location

Less Than $125 a Month

![]() 50 State Package

50 State Package

![]() Documentation

Documentation

![]() Customer Support

Customer Support

![]() Free Updates

Free Updates

![]() Unlimited Quotes

Unlimited Quotes

* Payable in Advance. Payments can be by PayPal, Credit Card, ACH or Company Check.

<<< Subscribe Today

What is the sales tax on a car in Missouri?

How do you figure sales tax on a car in Tennessee?

How do you calculate sales tax on a car in Texas?

Disclaimer: While Quick Tax Quote strives to maintain the most accurate and up-to-date database of sales tax rates and registration fees, we cannot guarantee absolute accuracy at all times. Rates and rules may change without notice. Users are responsible for reviewing all tax data and ensuring compliance with current local and state laws. Quick Tax Quote is not liable for any financial loss, penalties, or damages resulting from the use of this tool, including miscalculations due to data errors, input mistakes, or unannounced tax changes.